Trump Mobile’s $47 plan: What the data really says

Analysts called it a gimmick. The numbers could tell a very different story.

Summarize article with AI

When Trump Mobile launched earlier this year, the price alone made headlines. At $47.45 for its “47 Plan,” outlets like Fast Company called the number “puzzling” and a possible “marketing stunt.” Analysts debated whether it was symbolic, arbitrary, or a serious play in the crowded mobile market.

We wanted to find out what potential buyers, not the general public, were actually willing to pay. Using our Price Check feature, we measure real-world willingness to pay, showing where demand peaks and revenue potential is highest. The result is a clear view of the optimal price, the revenue-maximizing point, and where trust starts to drop.

How we tested

We surveyed 447 U.S. adults, but only those who said they were considering or planning to buy Trump Mobile were included. Anyone who had no interest was screened out. This led to a high dropout rate, in itself a sign of how polarizing the brand is, but it ensured the data reflects the actual prospect pool, not general public opinion.

The results

Key Findings:

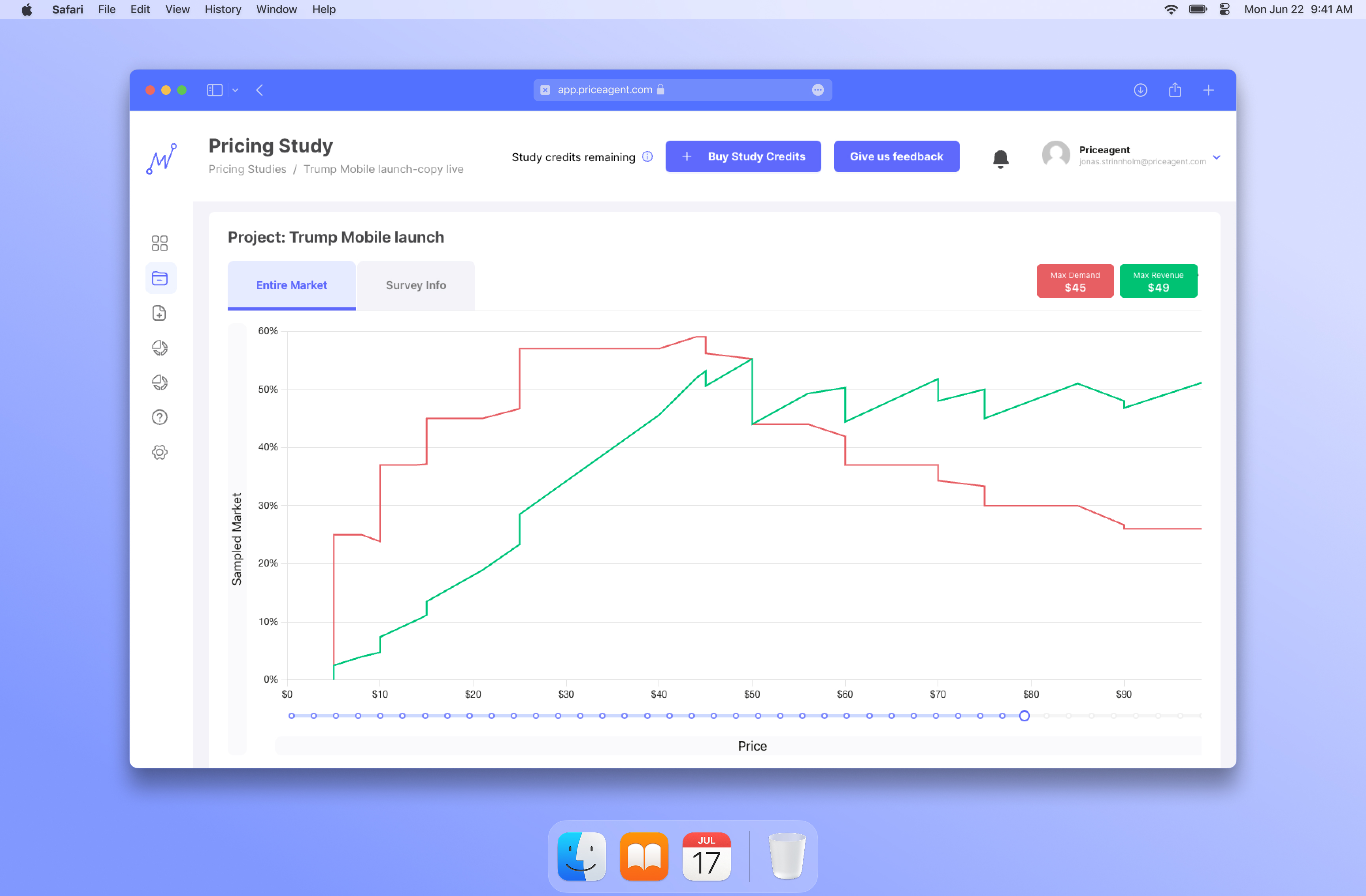

- Demand Peak: $44–45/month, almost identical to the actual $47.45 plan price.

- Revenue Peak: ~$49/month, showing slight headroom for revenue optimization.

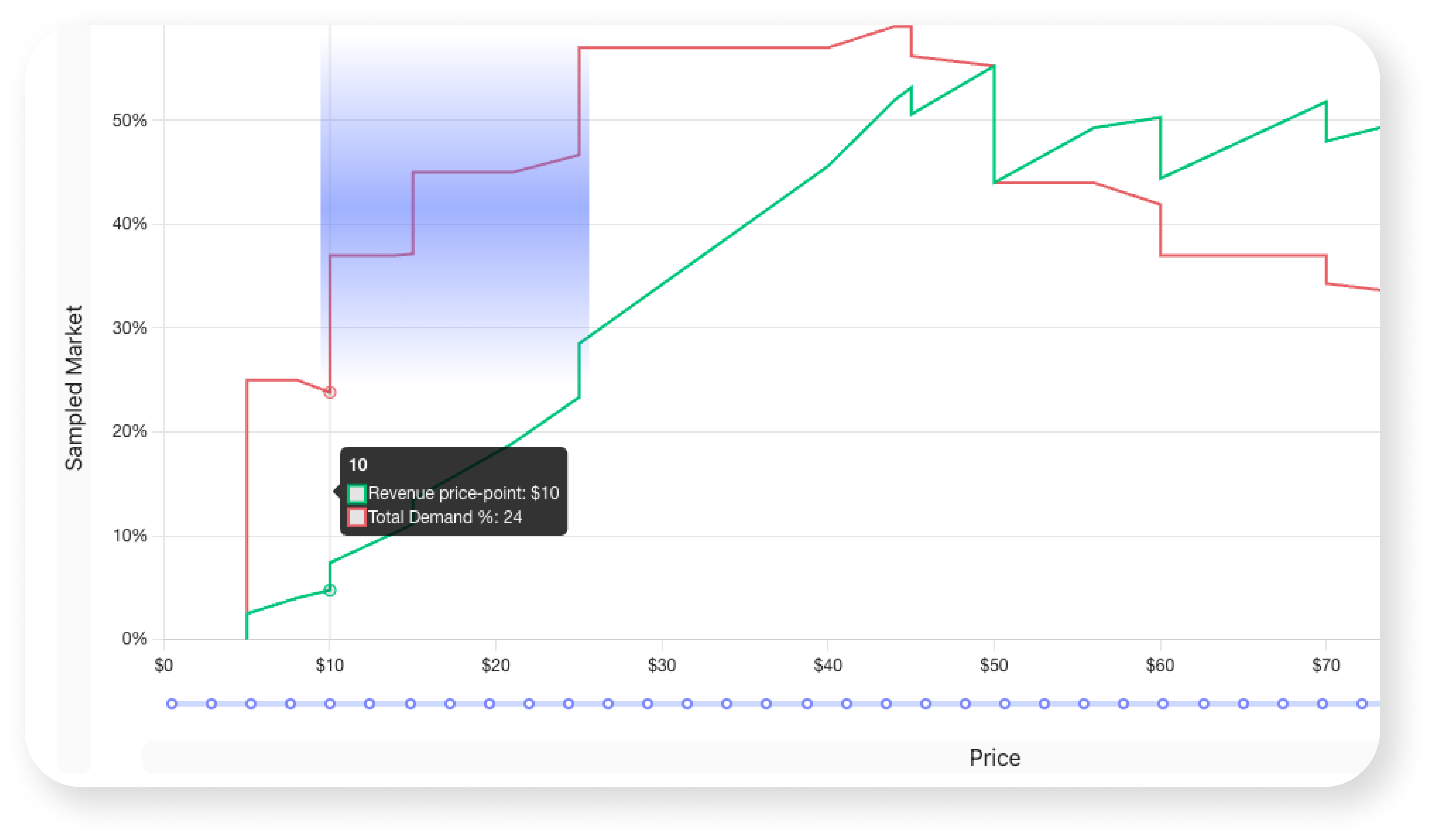

- Too Cheap = Distrust: Interest doubled when moving from the low teens into the mid-$20s, suggesting bargain pricing can harm credibility.

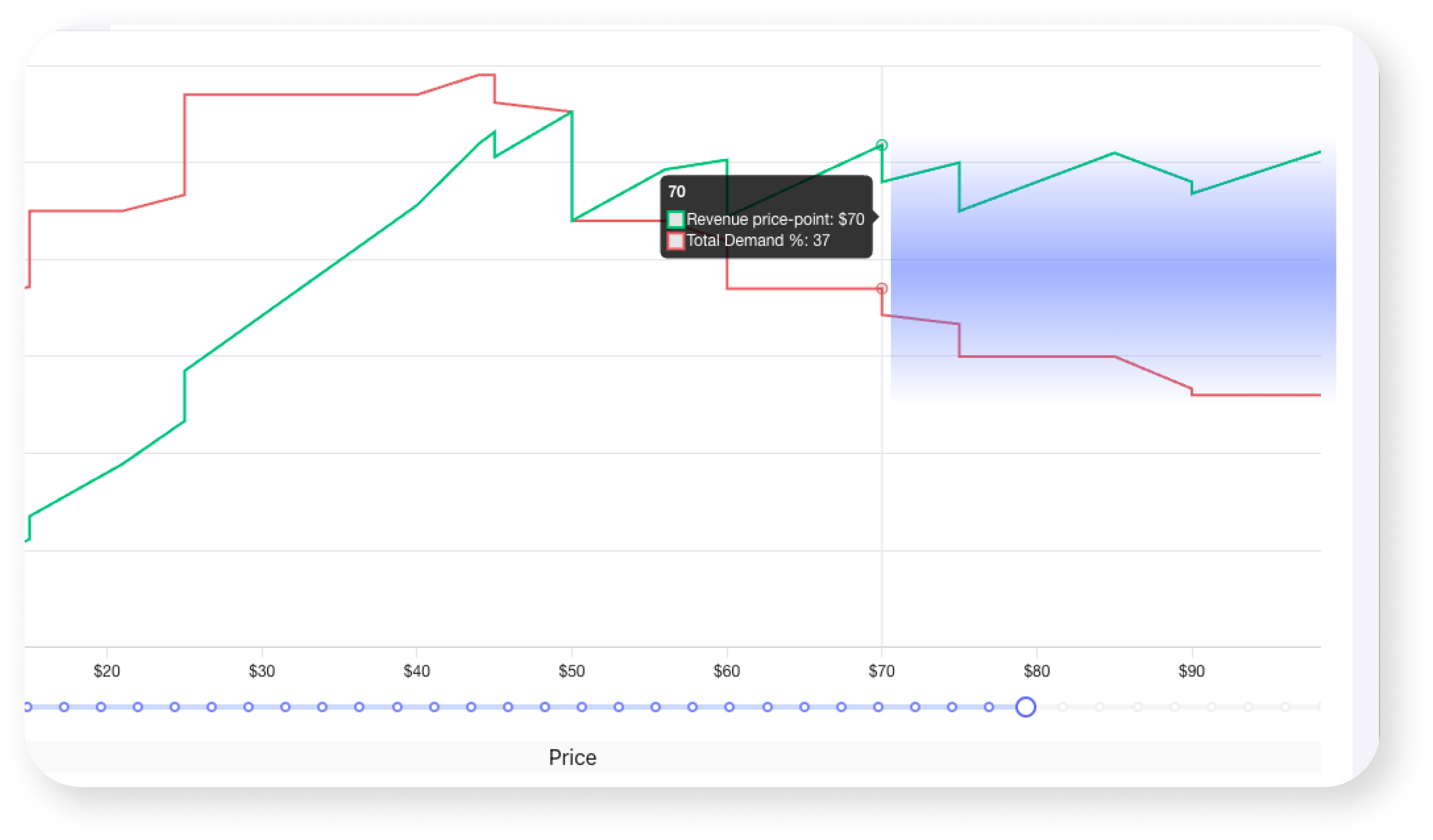

- Premium Tail: 25% of prospects would pay $70+ per month, supporting potential for tiered or bundled offers.

- Unexpected Audience: 60% of interested buyers are women, median age 47.

Why It Matters

This study highlights a few pricing truths that extend well beyond Trump Mobile.

First, the price point wasn’t a gimmick. It aligned with where demand was strongest and where revenue peaked just above. That tells us that pricing, even in polarizing or symbolic contexts, still follows a logic of perceived value.

Second, demand didn’t rise steadily with lower prices. In fact, being too cheap harmed credibility. That challenges the common idea that lower price equals broader appeal. It reinforces what we often see: pricing is also a trust signal. When buyers don’t believe the value story, they walk, even if the product is cheaper.

Third, a strong premium tail emerged. Some buyers were willing to pay far more, not because of features, but because of identity, alignment, or belief. This speaks to the power of pricing to capture emotional or symbolic value, a factor that applies to premium products, luxury goods, and even cause-based brands.

Finally, the demographic skew, mostly women, median age 47, reminds us that assumptions about “who the product is for” can be misleading. Pricing data doesn’t just show what people will pay, it reveals who is actually engaging with the offer.

In short: pricing isn’t just a number. It’s a mirror. It reflects how buyers perceive value, trust, identity, and fit and when measured properly, it tells you far more than a guess or a competitor benchmark ever could.

Explore the full study

→ View the interactive Trump Mobile Price Check results