The sustainability pricing gap: What customers say vs what they pay

Why green claims rarely justify a higher price and what to do instead.

Summarize article with AI

Introduction

Sustainability has become a default brand promise and a default pricing mistake. Polls show people say they’ll pay more for greener products. But sales data tells a different story. The so-called “green premium” rarely shows up at checkout. Harvard calls these the “elusive green consumers” (HBR). We just call them honest. Shoppers like the idea of green, but not at any price.

Brands that treat sustainability as marketing rhetoric risk leaving real value on the table. To close the attitude–behavior gap, companies must root sustainability in tangible product benefits like repairability, longer useful life, modular upgrades and build pricing strategy around those functional gains from day one.

The sustainability gap

Across studies from Nielsen (Nielsen 2023 Global Sustainability Survey), Deloitte (Deloitte Sustainable Consumer 2024]), and PwC (PwC Voice of the Consumer 2024), the message is consistent: over two-thirds of shoppers say they’d pay more for greener options. But in real transactions, that willingness rarely materializes. When Unilever A/B-tested two identical cleaning products, one labelled “planet friendly” at a higher price, the premium version under-performed by 30 percent (Unilever). In grocery, a Cornell field experiment showed that placing a 10 percent surcharge on organic milk cut unit sales in half even though customers previously claimed they would pay it.

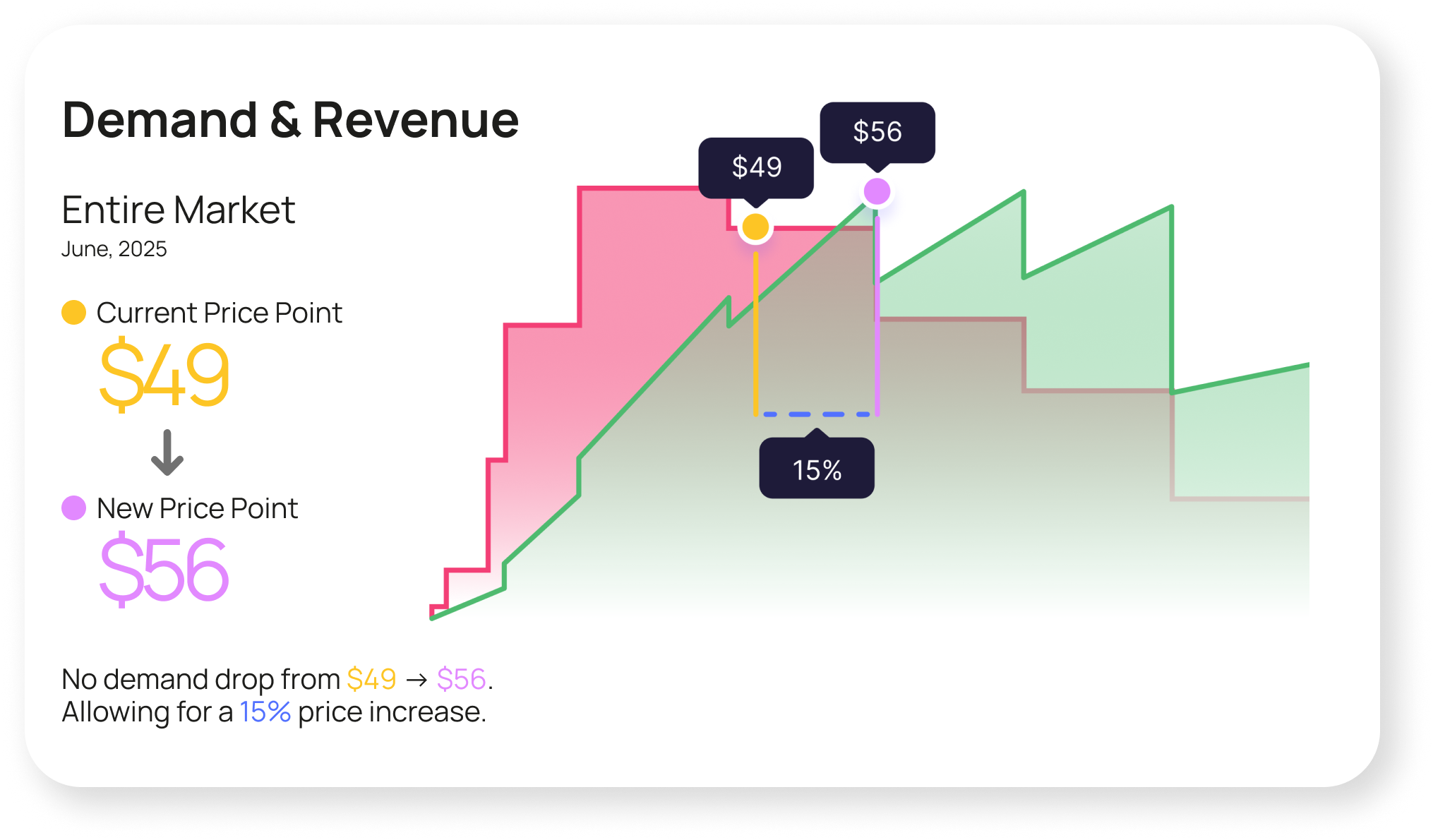

At Priceagent, we’ve tested over 200 products with sustainability claims. In most categories, those claims don’t drive willingness to pay. The exception? When green means useful, like durability in outdoor gear or repairability in tech. When sustainability feels functional, not just virtuous, pricing power improves.

As we shared with TechRound, many brands talk about sustainability. Few dare to price accordingly. And even when they do, the outcomes are often disappointing. Not because customers don’t care, but because of three persistent challenges:

- Self-report bias. Consumers often overstate eco-intentions because it feels good in a survey. When real money is involved, the rational calculator kicks in.

- Value comparison. Green benefits are hard to evaluate on the shelf. Price is easy to compare. If the sustainable option is more expensive and value is unclear, shoppers default to cost.

- Misaligned expectations. Without testing willingness to pay early, teams overestimate the commercial value of sustainability claims.

A brand cannot assume that positive attitudes will translate into premium pricing. The real-world willingness-to-pay test often exposes a painful truth. Good intentions alone do not close the sustainability gap. Brands must create visible, concrete value that makes the green choice feel like the smart choice, not the expensive one.

From green claims to functional value

Why sustainability needs to work, not just sound good

Sustainability often gets treated as a brand story, a nice-to-have layer rather than a core value driver. But if the benefit isn’t functional, visible, or felt by the customer, it rarely holds pricing power. “Eco-friendly” might sound nice, but unless it’s felt in use, it rarely moves the price needle. Want customers to pay more? Don’t say it’s greener. Show that it’s smarter: longer lifespan, lower total cost, better performance.

More concerning is how few companies test what kind of sustainability actually drives willingness to pay. Without that insight, it’s easy to overestimate value, misprice the offer, or miss the chance to build features customers genuinely care about.

We believe value comes not from sustainability promises, but from functionality customers can feel:

- Can it be repaired?

- Can you change the battery?

- Will it last longer?

These are features that turn environmental intent into perceived value. But to succeed commercially, being greener isn’t enough, the sustainable option must outperform the alternative in function, usage, or experience. Otherwise, customers will choose something else, even if it tugs slightly at their conscience.

Early signals from the market

- Right to Repair in the EU – The forthcoming directive will require spare-part availability for up to ten years on key electronics. Legislators estimate European households could save 18 billion EUR by extending product life spans.

- Fairphone – A modular phone with user-replaceable components and a five-year warranty designed around the idea “If you can’t open it, you don’t own it”.

- Framework Laptop – A notebook built so owners can swap motherboards, ports or keyboards with a screwdriver, turning longevity into a selling point.

- Patagonia Worn Wear – Repairs and resells used garments, reinforcing product durability as part of the brand promise.

These examples suggest that when sustainability becomes a feature customers can see and experience, it resonates more strongly than a generic eco label. While hard willingness-to-pay data is still limited, the traction these brands gain hints that functional sustainability is moving from niche proof-of-concept to mainstream expectation.

Price is not a cost, it's a decision. Make it early.

Most brands price too late. Sustainability costs become margin hits. Features that could justify a premium get added without proof they’re worth it. Pricing should start on page one of the product brief. That’s how you make sustainability a business case, not a gamble.

McKinsey notes that goods designed with a value-based price target generate up to 3 percent higher margins than those priced later. When the brief includes a clear price hypothesis, every design choice like materials, repairability, modular extras, can be judged against the customer value it creates.

Classic cost-plus math hides the story. Value-based pricing reframes the discussion around outcomes customers care about: fewer replacements, lower lifetime cost, resale potential. Harvard Business Review calls this “moving from eco message to eco math” and shows that translating a greener feature into quantifiable savings makes a premium feel logical. For example, if a modular headphone saves buyers one complete replacement every four years, the saving can justify a higher upfront price.

At Priceagent, our database holds thousands of pricing studies. Yet only 200 included sustainability attributes, and few brands asked for deeper probes like repairability versus generic green claims. That hesitation is costly. A simple pricing study early in concept development can reveal which functional sustainability signals drive purchase and how large the acceptable premium is. Without that data, teams risk overpricing and killing adoption, or underpricing and eroding margins.

Practical steps:

- Include the features you're planning to build. Capture attributes like “repairable battery” or “5-year part availability” as part of the product concept. The resulting data shows which features create pricing power and which don’t.

- Describe the benefits clearly. Replace general claims like “planet friendly” with specifics such as “60% recycled shell that lasts 30% longer.” Specifics create stronger value signals.

- Look for pricing power, not just preference. If a feature helps sustain demand at higher prices, you have evidence for premium positioning and a clearer story to support it.

Price is not an afterthought. It is a design constraint and a communication tool. Integrate pricing from day one, tie it to functional sustainability benefits, and validate the premium through early customer testing. Brands that take this route turn green intent into real market traction instead of marketing noise.

Conclusion

Broad green slogans won’t justify a premium. Functional sustainability might. But only if you test what customers actually value before launch. Price isn’t just a number. It’s a design constraint, a communication tool, and your best shot at turning green ambition into real traction.

If you’re building the greener option, don’t price it blind. Run a real willingness-to-pay test. That’s how you turn good intent into great outcomes.